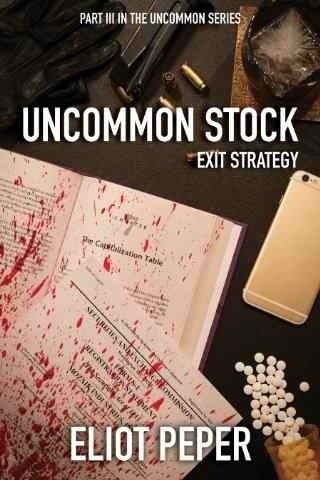

"Uncommon Stock: Exit Strategy" by Eliot Peper

The final book in the Uncommon Stock series hit the shelves on July 29, 2015 and if you were like me you had already pre-ordered it so it would be instantly sent to your Kindle.

If you missed the launch of the Part III, don’t worry you can pick it up from Amazon for only $4.99 (it is a steal).

Trust me you will not be disappointed with Part III, just as the first two books were well worth it. Now if you haven’t read them yet I would suggest you read all three in order (here is my take on Part II, Uncommon Stock: Power Play).

I was really excited to see how the whole journey of Mara and James unfolded in this book and it was too perfect that it hit the shelves right before I had a long trip to China. I started reading it on my long flights and wished I wouldn’t have had other things that kept distracting me along the way.

However, since the team I was with never went into work until 8am I had plenty of time after waking up at 4am, as I wasn’t able to sleep any longer, to continue reading. The only bad part about that was I didn’t want to put it down when I knew it was time to catch the cab. Also, it helped that domestic flights in China seem to be delayed often which allowed me to finish the book and write this posting.

Now onto Exit Strategy, the story puts you right back into the fast-paced life of the Mozaik startup roller coaster.

Eliot does a great job keeping your thoughts focused on wondering what Mara is going to do next and how are they ever going to take down Maelstrom. Not to mention you are captivated by the underlying story about Mozaik, the company you have been rooting for since Part 1. He does a great job walking you through some of the real-life examples of the pains that Startups go through from the beginning all the way through IPOs. Honestly, this is one of those books that touches on so many topics that it probably appeals to people that like all kinds of books from mystery, suspense and action. Then to top that off it is about this Startup company trying to catch people involved in financial fraud, murder, and deception.

Now I could probably write on and on about what happened but that would just ruin the fun of reading it. So I will at least give you a couple of my favorite quotes/sayings from the book that stuck out to me. I think each of these just go to show the amount of information beyond being a good story is packed into this book and more specifically this series.

The short version is that when you lay good code on top of bad code, the result is still bad code.

You can’t wait until you had enough time for exercise. You had to make time for it no matter what.

Economics, the science of explaining tomorrow why the predictions you made yesterday didn’t come true today.

There is something ephemeral but infinitely satisfying about starting something yourself. Your shit is on the line and you and your team are where the buck stops. If you get a kick out of that, then you end up having few other employment choices. If you’ve got that bug, you essentially have to start a company or get involved with startups. Otherwise, your brain starts to rot and you get all bitchy and miserable.

Finally, at the end of the book after it is all done (don’t worry I am not going to spoil the ending) but Eliot Peper hinted at coming out with a new book (not part of this series) in Spring of 2016. So if you are like me and enjoy his style of writing you probably should following him on twitter (@EliotPeper) and subscribe to his newsletter from his website.